Fonds Négociés en Bourse de Vin (Ce Qu'ils Sont et Comment Investir en Eux)

14 min de lecture

Head of Content

Qu'est-ce que les ETFs

Les Fonds Négociés en Bourse (ETFs) sont un type de fonds d'investissement et de produit négocié en bourse, représentant un ensemble de titres tels que des actions qui suivent régulièrement un indice sous-jacent, bien qu'ils puissent investir dans n'importe quel nombre de secteurs industriels ou utiliser diverses stratégies. Essentiellement, les ETFs sont similaires aux fonds communs de placement, mais ils sont négociés ouvertement comme une action individuelle sur une bourse.

Contrairement aux fonds communs de placement qui sont évalués à la fin de chaque journée de négociation, les ETFs sont évalués en continu tout au long de la journée de négociation. Cette tarification perpétuelle s'aligne sur la qualité fluctuante du marché, et donc, donne aux investisseurs la liberté d'acheter et de vendre des actions d'ETF à tout moment pendant les heures de négociation régulières comme ils le feraient avec des actions ordinaires.

Bien que les ETFs, essentiellement, visent à imiter la performance de leurs indices de référence, il est d'une importance capitale de rappeler que l'imitation ne signifie pas nécessairement réplique. Ainsi, bien qu'un ETF puisse s'efforcer de refléter le rendement de son indice de référence, une correspondance parfaite n'est jamais garantie. Les investisseurs sont souvent agréablement surpris de constater que les ETFs surperforment parfois ce qui est appelé surperformance par rapport à leurs indices de référence ; d'autre part, il n'est pas rare de trouver des ETFs sous-performant par rapport à leurs indices de référence, un phénomène connu sous le nom de sous-performance.

Un autre aspect vital de la compréhension des ETFs concerne leur processus de création et de rachat. Lorsqu'un fournisseur d'ETF souhaite créer une nouvelle tranche d'un ETF, il choisit un participant autorisé, généralement un grand investisseur institutionnel, pour acquérir l'ensemble des actifs que l'ETF vise à suivre. Ces actifs, souvent appelés collectivement un 'Panier de Création', sont ensuite échangés contre de nouvelles actions d'ETF de valeur égale. Le processus inverse est exécuté lorsque des actions doivent être "rachatées" ou retirées de la circulation.

Les ETFs sont salués pour leur polyvalence caractéristique, attribuable, sans aucun doute, à la liste expansive d'actifs dans lesquels ils permettent d'investir. Les investisseurs peuvent choisir des ETFs qui se concentrent sur tout, des actions traditionnelles et des obligations aux produits ciblant des matières premières plus exotiques telles que l'or, le pétrole ou, dans ce contexte, le vin et l'alcool - le point focal de ce discours.

Comment Acheter des ETFs de Vin ?

On rencontre souvent la réalité indiscutable : il existe zéro ETFs exclusivement dédiés à l'investissement dans le vin.

Cependant, ce n'est pas une impasse pour les passionnés de vin. Un chemin possible pour l'investissement existe dans des ETFs à large base, ceux qui intègrent le vin dans leur portefeuille, généralement classés comme des ETFs d'alcool.

Qu'est-ce que les ETFs d'Alcool ?

Les Fonds Négociés en Bourse (ETFs) se concentrant sur l'industrie de l'alcool, particulièrement appelés ETFs d'Alcool, désignent des actifs qui offrent aux investisseurs la possibilité de générer des bénéfices grâce à des expositions dans le secteur des boissons, plus spécifiquement, les boissons alcoolisées. Ces véhicules d'investissement assemblent un pool de différents instruments financiers tels que des devises, des obligations, des matières premières et des actions comme celles des entreprises engagées dans la production, la distribution et la vente de boissons alcoolisées - bière, vin et spiritueux pour être précis.

Ces ETFs s'appuient fortement sur le secteur des produits de consommation de base, dépendant des niveaux de revenu discrétionnaire et de la santé économique des consommateurs. Cela rend fondamentalement la performance des ETFs d'Alcool largement résiliente aux ralentissements économiques, un avantage unique qui les classe comme des investissements défensifs ou non cycliques. De plus, ils bénéficient de la popularité mondiale et de l'ubiquité des boissons alcoolisées, ce qui en fait des opportunités d'investissement attrayantes à long terme.

Les ETFs d'Alcool suivent généralement la performance des indices associés à l'industrie de l'alcool. La composition des ETFs dépend de l'indice respectif, suivant des entreprises de différentes tailles et emplacements géographiques. Ces ETFs peuvent détenir des actions d'entreprises allant de conglomérats multinationaux dominant le marché international de l'alcool, tels qu'Anheuser-Busch InBev, Diageo et Pernod Ricard, à des entreprises plus petites ayant une présence régionale.

Des réglementations légales strictes entourant l'industrie de l'alcool, des dynamiques de marché concurrentielles et des facteurs sociaux influençant les normes de consommation sont quelques-uns des risques uniques associés à ces ETFs. Ainsi, les investisseurs doivent prendre en compte ces facteurs lors de l'évaluation du profil risque-rendement des ETFs d'alcool.

Meilleurs ETFs d'Alcool dans lesquels Investir

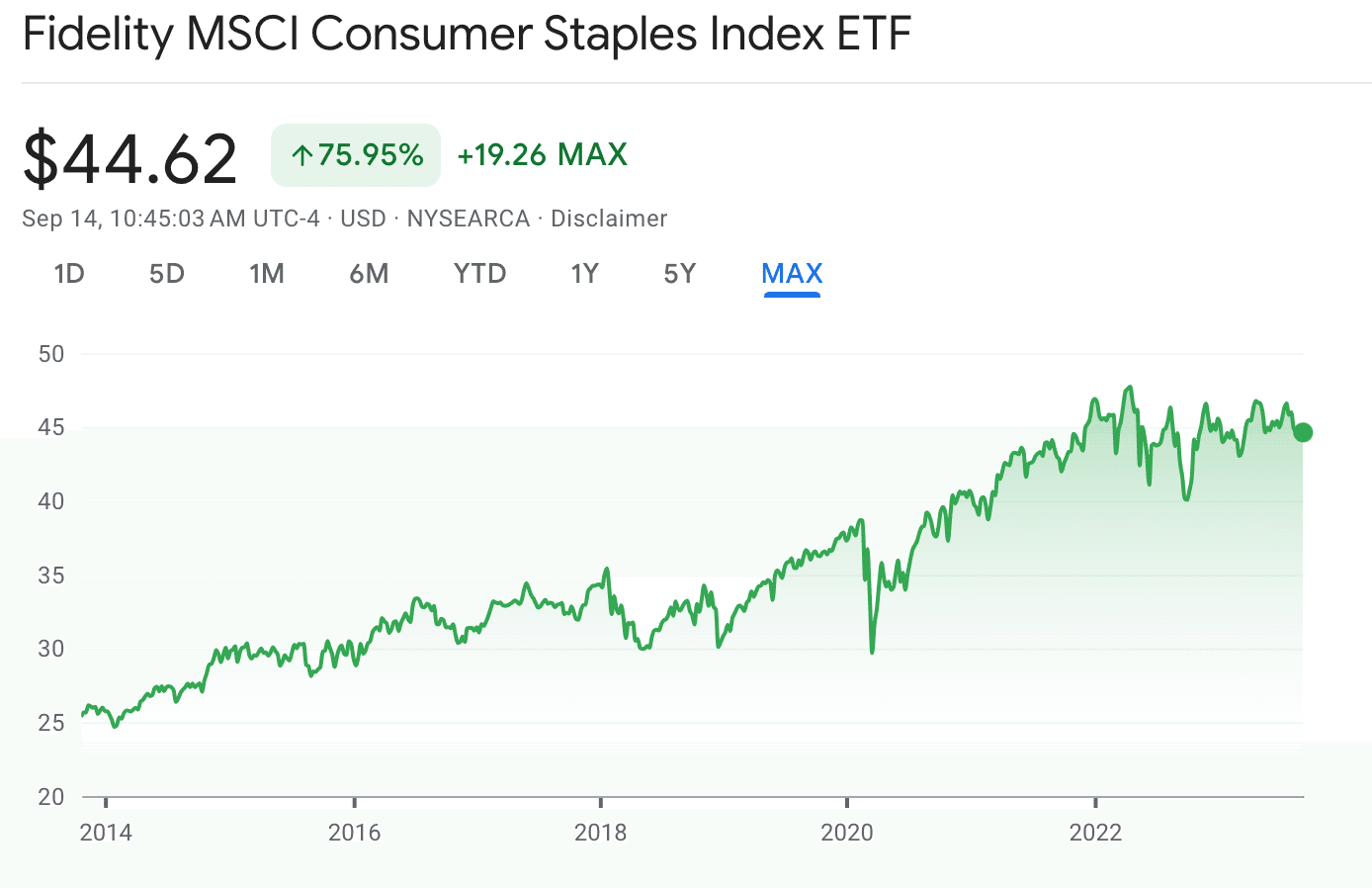

Fidelity MSCI Consumer Staples Index ETF

Le Fidelity MSCI Consumer Staples Index ETF (FSTA) est une opportunité d'investissement liée à l'industrie du vin et de l'alcool. Il suit l'indice MSCI USA IMI Consumer Staples, avec un accent sur des secteurs comme l'alimentation, le commerce de détail de produits de base, les boissons, et plus encore. Notamment, les boissons, y compris l'alcool, représentent environ 22 % de l'indice.

FSTA suit une stratégie d'investissement passive, visant à faire écho à la performance de l'indice plutôt que

Source : Google Finance

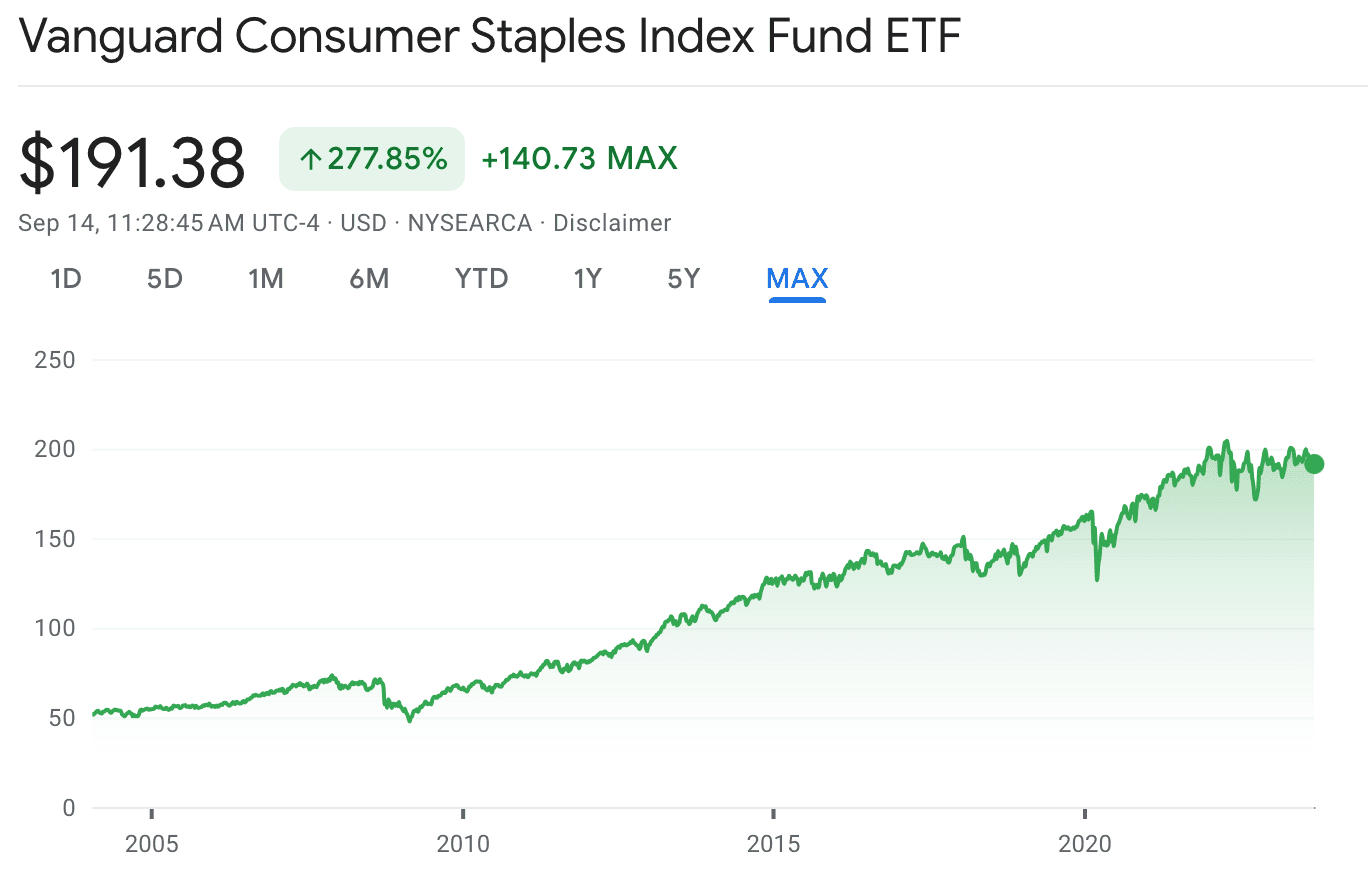

Vanguard Consumer Staples Index Fund ETF (NYSEARCA: VDC)

Le Vanguard Consumer Staples Index Fund ETF (VCSAX) est un choix populaire sur le marché financier, d'entreprises américaines dans le secteur des produits de consommation de base. Il a un style de gestion passive avec un faible ratio de dépenses de 0,10 %.

Les investisseurs peuvent obtenir une exposition étendue aux entreprises d'alcool comme Anheuser-Busch InBev et Diageo grâce à ce fonds. Comme ces produits voient souvent une consommation accrue lors des ralentissements économiques, investir dans ce fonds est considéré comme relativement sûr.

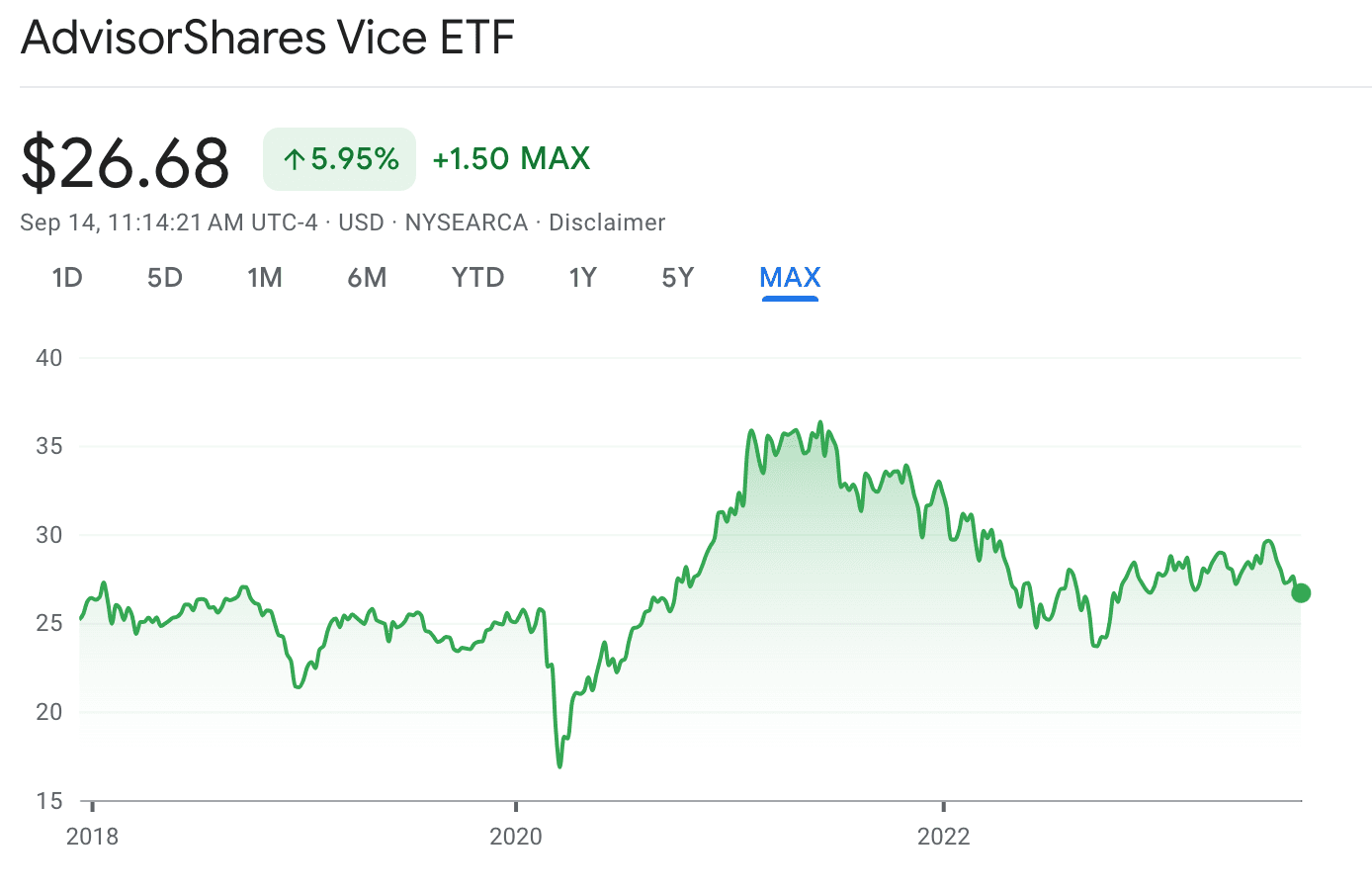

AdvisorShares Vice ETF (NYSEARCA: VICE)

L'AdvisorShares Vice ETF est un ETF thématique qui investit dans des industries de "péché" comme la production d'alcool. Il participe à des entreprises de vin, de spiritueux, de bière et d'autres boissons alcoolisées, bénéficiant d'une consommation constante efficacement au milieu des changements économiques.

Lancé en 2017, cet ETF (symbole : ACT) se distingue des ETFs d'alcool standard car il intègre les secteurs du tabac et du cannabis. Son portefeuille distinct offre une exposition diversifiée aux industries de "péché", en particulier l'alcool.

L'AdvisorShares Vice ETF a montré sa résilience face aux fluctuations du marché, soulignant la robustesse de ses secteurs cibles. Cet ETF possède une variété de plus de 40 actions de capitalisations boursières variables, allant de grandes entreprises de brasserie à de plus petits producteurs de vin.

Source : Google Finance

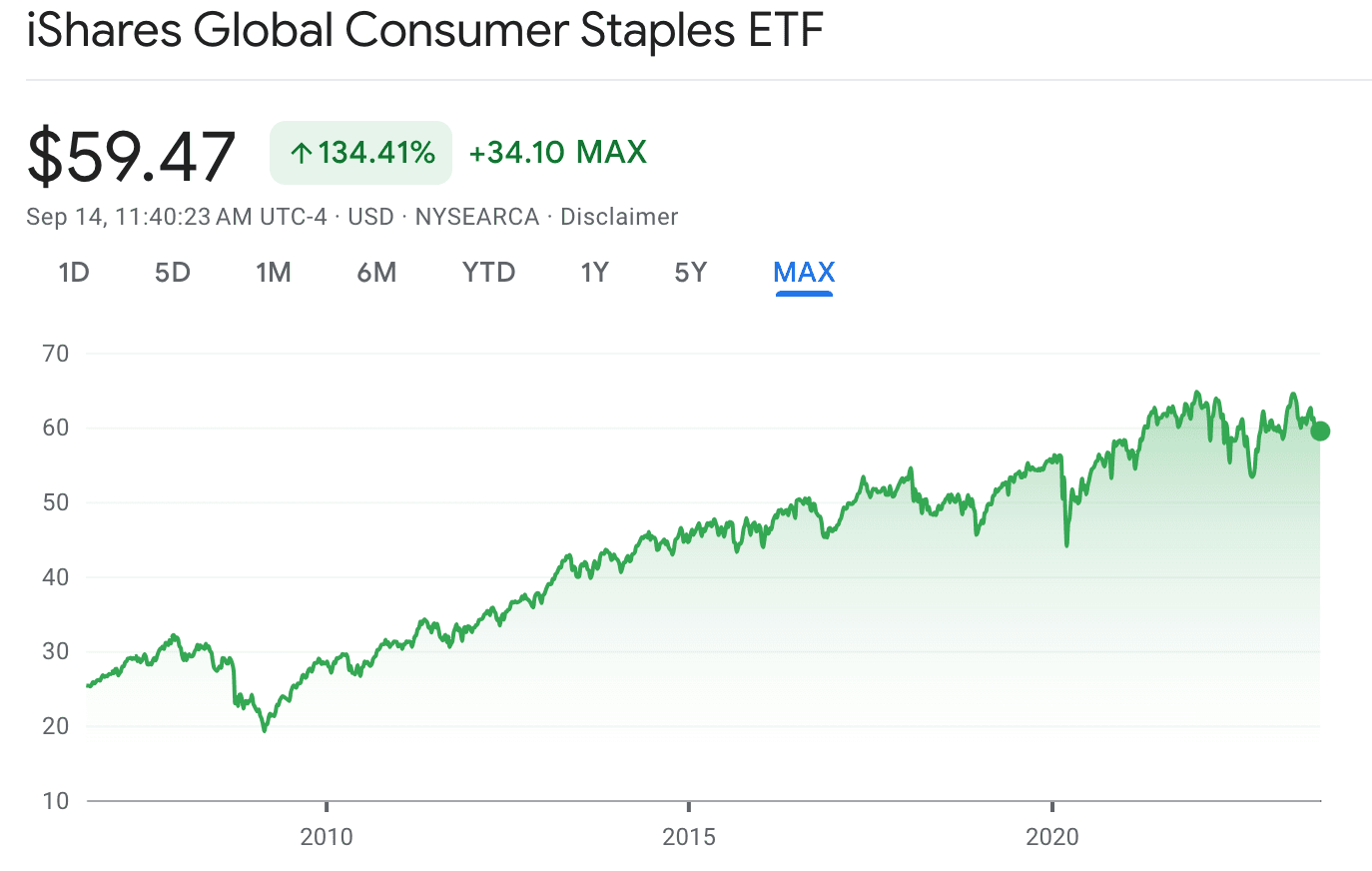

iShares Global Consumer Staples ETF (NYSEARCA: KXI)

L'iShares Global Consumer Staples ETF (KXI) est un fonds couvrant le marché mondial et Coca-Cola. Ces entreprises représentent une grande partie de l'ETF.

L'ETF vise à imiter la performance de l'indice S&P Global 1200 Consumer Staples Sector Index, utilisant une stratégie de gestion passive. Il permet aux investisseurs de bénéficier de l'appréciation du capital et des paiements de dividendes de ses avoirs.

Les investisseurs intéressés par l'industrie du vin peuvent envisager cet ETF. Bien qu'il ne soit pas exclusivement axé sur le vin ou les boissons alcoolisées, de nombreuses entreprises alimentaires et de boissons dans le portefeuille sont également impliquées dans la production et la distribution de vin et d'alcool.

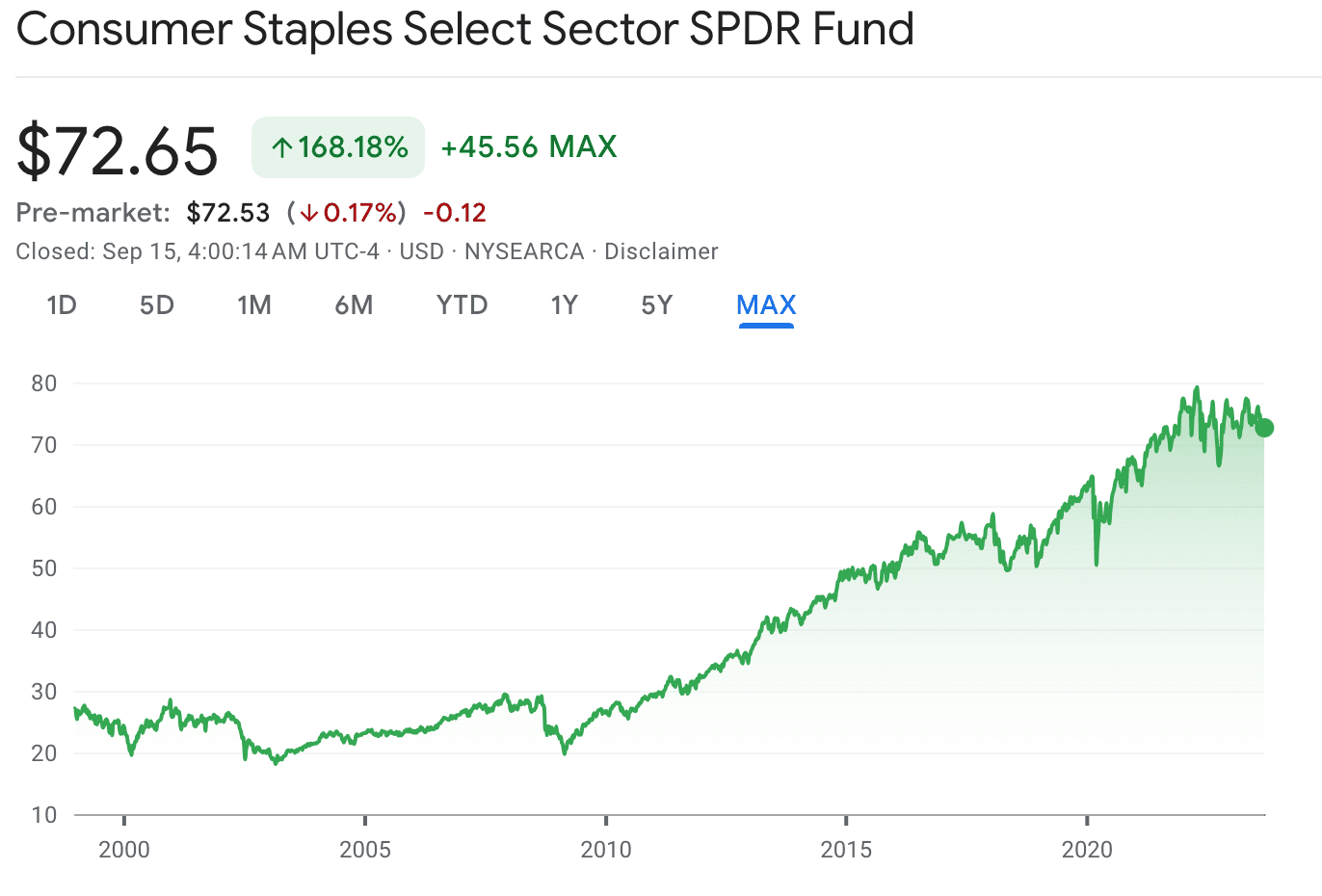

Consumer Staples Select Sector SPDR Fund (NYSEARCA: XLP)

Le Consumer Staples Select Sector SPDR Fund (XLP) est un choix fiable sur le marché des ETFs d'alcool. Initié en 1998, il suit l'indice Consumer Staples Select Sector Index. L'indice comprend une gamme diversifiée d'entreprises comme celles dans l'alimentation, le commerce de détail de médicaments, les boissons, le tabac et les produits ménagers.

À la fin de 2021, il a un faible ratio de dépenses de 0,12 %, ce qui le rend rentable pour les investisseurs prévoyant un investissement à long terme.

Par conséquent, l'ETF XLP est un favori parmi les investisseurs, tant nouveaux qu'expérimentés, pour sa stabilité, son exposition diversifiée à des secteurs de base comme l'alcool et les boissons, et son potentiel de rendements réguliers.

Investir dans l'industrie du vin via des Fonds Négociés en Bourse (ETFs) présente certainement une opportunité intrigante. Cependant, il est crucial de comprendre que ces ETFs ne permettent que d'investir dans le vin comme une partie d'une classe d'actifs plus large, plutôt que de permettre d'investir exclusivement dans le vin.

Heureusement, il existe d'autres moyens d'apprécier le marché secondaire du vin à haut rendement.

Investir dans des Actions de Vin

Constellation Brands, Inc. (NYSE: STZ)

Constellation Brands, Inc. est un nom bien connu dans le secteur de l'alcool, en faisant une solide opportunité d'investissement. Établie en 1945, elle possède une impressionnante collection de marques d'alcool, montrant sa croissance remarquable.

D'un point de vue fiscal, l'entreprise a démontré un bilan continu de rendements robustes et de croissance des revenus. Au cours de l'exercice fiscal 2020, l'entreprise a affiché une croissance des ventes nettes de 3 % par rapport à l'exercice fiscal précédent et a réalisé un flux de trésorerie d'exploitation d'environ 2,1 milliards de dollars. Son segment d'activité de bière a enregistré une croissance des ventes nettes de 8 % au cours de la même année.

À la Bourse de New York, Constellation Brands, Inc. se négocie sous le symbole boursier 'STZ'. Les données fiscales de Constellation Brands révèlent un bilan continu de rendements solides et de croissance des revenus. Certaines marques emblématiques sous son égide incluent Corona Extra, Modelo Especial, Robert Mondavi, Kim Crawford, Ruffino et SVEDKA Vodka.

Diageo plc (NYSE: DEO)

Diageo plc est une entreprise britannique multinationale de boissons renommée pour sa large gamme de spiritueux, de vins et de bières de classe mondiale. Avec son siège à Londres, l'entreprise maintient une présence significative dans l'industrie mondiale du vin, ce qui en fait une considération d'investissement pour ceux intéressés par des instruments financiers axés sur le vin.

Notamment, Diageo détient la distinction d'être le plus grand producteur de spiritueux au monde, avec un portefeuille incroyable qui comprend des marques renommées telles que Don Julio, Tanqueray, Baileys et Guiness. Cependant, leur valeur d'investissement ne découle pas uniquement de leurs offres de spiritueux. Dans le paysage viticole, Diageo possède un nombre substantiel de domaines viticoles et d'étiquettes prestigieuses, positionnant ainsi l'entreprise favorablement sur le marché boursier d'un point de vue centré sur le vin.

À l'heure actuelle, l'action Diageo (DEO) est cotée à la fois sur les Bourses de Londres et de New York. D'un point de vue d'investissement, plusieurs facteurs convaincants attirent l'attention sur cette action. Premièrement, Diageo a constamment montré une forte performance en termes de revenus et de paiements de dividendes, dépeignant une image d'investissement fiable et stable. De plus, le modèle commercial robuste de l'entreprise, soutenu par des offres d'alcool diversifiées et une large empreinte géographique, réduit sa susceptibilité aux fluctuations du marché et renforce sa résilience face aux ralentissements économiques.

Brown-Forman Corporation (NYSE: BF.B)

La Brown-Forman Corporation, cotée à la Bourse de New York sous le symbole boursier BF.B, est un acteur notable dans l'industrie mondiale des boissons alcoolisées. Cette corporation multifacette, établie en 1870, opère dans plus de 170 pays et possède un portefeuille impressionnant de plus de 25 marques.

Financièrement, la Brown-Forman Corporation présente une santé robuste, néanmoins, investir dans ses actions nécessite une analyse de différents éléments. Les paiements de dividendes constants de la corporation et un programme progressif de rachat d'actions sont des facteurs à prendre en compte par les investisseurs potentiels.

L'engagement de l'entreprise à augmenter ses paiements de dividendes aux actionnaires est un fort indicateur fiscal. La Brown-Forman Corporation a réussi à augmenter ses dividendes chaque année pendant les 37 dernières années, manifestant une stabilité financière. Récemment, la corporation a augmenté ses dividendes de 5 %, une tendance progressive qui suggère un bien-être prometteur.

Un autre facteur qui incarne la santé financière de cette corporation est son programme de rachat d'actions. Au cours des dix dernières années, la Brown-Forman Corporation a racheté environ 2,5 milliards de dollars de ses propres actions, entraînant une réduction des actions en circulation. Cette activité génère de la valeur pour les actionnaires, car elle augmente les bénéfices par action et conduit souvent à une hausse des prix des actions.

Willamette Valley Vineyards, Inc. (NASDAQ: WVVI)

Willamette Valley Vineyards, Inc. est un producteur et cultivateur de premier plan de vins fins élaborés à partir du raisin Pinot Noir, reconnu comme l'une des principales appellations d'Amérique pour cette variété. Ses vignobles sont situés dans la vallée de Willamette en Oregon, une région acclamée pour produire certains des Pinot Noir de la plus haute qualité au monde en raison de son climat et de ses conditions de sol uniques. Les actions de l'entreprise se négocient sur le NASDAQ sous le symbole boursier WVVI.

Willamette Valley Vineyards a démontré une performance forte et constante sur un marché hautement concurrentiel, dépassant de nombreux concurrents de l'industrie. Cette observation est soulignée par ses données financières historiques. Cependant, comme tout autre investissement, celui-ci nécessite également une analyse approfondie de ses indicateurs de performance sous-jacents.

L'entreprise rapporte fréquemment des chiffres opérationnels robustes, avec de nombreux indicateurs de croissance. Par exemple, la croissance constante des revenus de l'entreprise sur plusieurs exercices fiscaux reflète sa forte présence sur le marché et la demande des consommateurs pour ses produits. Cela est en partie dû à leurs efforts stratégiques en matière de branding et de diversification des produits, leur permettant de s'attaquer à une large base de consommateurs tout en maintenant la qualité.

Les bénéfices par action (EPS) de l'entreprise montrent également une tendance à la hausse notable, un signal prometteur pour la croissance future. Cela dresse un tableau de la rentabilité de l'entreprise sur une base par action et fournit des informations sur la santé financière de la société. Un EPS en croissance indique fréquemment la capacité d'une entreprise à générer des bénéfices et à les retourner aux actionnaires.

LVMH Moet Hennessy Louis Vuitton SE (EPA: MC)

LVMH Moet Hennessy Louis Vuitton SE, communément appelé LVMH, représente une opportunité intrigante pour les investisseurs cherchant à diversifier leur portefeuille à travers des participations dans le secteur de l'alcool et des biens de luxe. Le conglomérat, dont le siège est en France, possède une vaste gamme de marques prestigieuses sous son registre, y compris des marques de vin et de spiritueux notables telles que Moet & Chandon, Hennessy, Dom Perignon et Veuve Clicquot.

LVMH a démontré un schéma constant de croissance des revenus et de rentabilité, attribuable à la puissance et à l'attrait durables de ses marques. Ainsi, investir dans l'action LVMH pourrait servir efficacement de substitut à un investissement diversifié dans le marché mondial des vins et spiritueux haut de gamme. Cependant, les investisseurs doivent comprendre les risques inhérents associés à tout type d'investissement en actions.

D'un point de vue financier, LVMH a rapporté un chiffre d'affaires de 44,65 milliards d'euros pour le premier semestre de 2021, marquant une reprise notable par rapport à la baisse subie en 2020 en raison de la pandémie de Covid-19. Leur secteur des vins et spiritueux à lui seul a contribué à 10 % de ce chiffre d'affaires global, reflétant la demande soutenue pour des vins et spiritueux haut de gamme même à la suite de perturbations économiques.

Leur modèle commercial stratégique qui englobe non seulement les vins et spiritueux mais aussi la mode, les parfums et cosmétiques, et les bijoux entre autres, offre un certain degré d'isolation contre les ralentissements ou perturbations spécifiques au secteur. Les flux de revenus diversifiés réduisent potentiellement le risque associé aux investissements purs dans le vin.

Fonds de Vin

Les fonds de vin, dans leur nature essentielle, ressemblent de près aux fonds de capital-investissement. Cette remarquable similarité est la raison pour laquelle les conseillers financiers supposent souvent que ces fonds sont des courtiers de bénéfices potentiels pour les investisseurs.

Gérés avec diligence par des gestionnaires de fonds possédant une connaissance approfondie du domaine, ces fonds de vin élèvent le scénario d'investissement.

Wine Source Fund

Ce fonds vous permet d'investir dans un portefeuille diversifié de vins fins internationaux et de vignobles.

Géré par - WSF SICAV.

Rendements Annuels - 7 %.

The Wine Investment Fund

Ce fonds vous permet d'investir spécifiquement dans des vins de Bordeaux qui sont stockés dans des entrepôts sous douane, et vendus au bon moment.

Géré par - Anpero Capital.

Rendements Annuels - 7,1 %.

Vini Sileo Vineyard Fund

Ce fonds vous permet de posséder des vignobles en France, au Portugal et en Italie grâce à des participations fractionnées (plusieurs parties partagent et atténuent le risque de propriété).

Géré par - Vinito Capital Management.

Rendements annuels - 10 %.

Sommelier Capital Advisors Hedge Fund

C'est un fonds d'investissement mondial de vin géré activement.

Géré par - Sommelier Capital Advisors.

Rendements annuels - Non disponibles.

Watermark Fine Wine

Ce fonds négocie activement un portefeuille de récentes récoltes de vins de Bordeaux de premier cru.

Géré par - Watermark Fine Wine.

Rendements annuels - Non disponibles.

Il est crucial de comprendre qu'engager des investissements dans des fonds de vin présuppose la probabilité que vos fonds soient enchevêtrés dans le réseau d'investissement pendant une durée allant jusqu'à cinq ans. La procédure pour obtenir le rachat de votre demande pourrait englober un délai de plusieurs semaines.

Une stratégie alternative qui a du charme est l'acquisition de bouteilles de vin de qualité d'investissement, les sécurisant dans un stockage, et les offrant ensuite à la vente lors de prestigieuses enchères de vin ou sur des bourses de vin exclusives, telles que la renommée London International Vintners Exchange (Liv-Ex).

Vous pourriez acheter des premiers crus et des vins de premier cru de Bordeaux, Bourgogne, ou toute autre région viticole réputée.

Le meilleur dans tout ça est : vous n'avez pas à faire tout cela vous-même - utilisez simplement un marché de vin de collection comme Rekolt.

Voyons comment vous pouvez faire cela.

Investir Directement dans des Bouteilles de Vin avec Rekolt

Rekolt est une plateforme qui vous permet de collecter des vins recherchés qui surperforment historiquement le marché.

Comment Investir avec Rekolt

Vous devez suivre un simple processus en trois étapes :

Acheter un vin sur le marché

Suivre votre portefeuille en temps réel.

Pourquoi Devriez-Vous Utiliser Rekolt ?

Rekolt facilite l'achat et la gestion des vins. Nous recherchons, authentifions, achetons, stockons et assurons le vin pour vous.

Authenticité

Rekolt trace la provenance et vérifie l'authenticité de chaque bouteille de vin.

Meilleurs Prix

Nous sourçons des vins directement auprès des vignobles, des bourses de vin mondiales et des marchands aux meilleurs prix de gros possibles.

Stockage Optimal

Les caisses de vin sont stockées dans des conditions optimales d'humidité, de température, de qualité de l'air, de lumière et de vibration avec des fournisseurs de stockage expérimentés.

Assurance Complète

Notre politique couvre toute casse ou fuite accidentelle qui pourrait survenir, garantissant que les investissements de nos clients restent sûrs et sécurisés. En cas de dommage ou de perte, vous serez immédiatement informé et remboursé sur votre compte.

Quels Sont les Avantages d'Investir par le Biais de Rekolt Plutôt que par des ETFs ?

Il y a trois avantages clés à investir dans le vin via Rekolt par rapport aux ETFs :

Il fournit une solide couverture contre la volatilité du marché (contrairement à l'immobilier ou aux marchés boursiers). Considérez ceci : le vin a surperformé l'indice S&P 500 au cours des 20 dernières années, y compris pendant les ralentissements.

Vous pouvez investir uniquement dans le vin, plutôt que dans un mélange de matières premières qui peuvent ou non garantir des rendements stables.

Vous obtenez une pleine propriété des vins dans lesquels vous investissez.

Bien qu'investir dans des ETFs d'alcool puisse vous aider à investir dans des vins, ce n'est pas une option idéale.

Vous serez mieux loti en utilisant une plateforme en ligne de confiance comme Rekolt pour sélectionner, acheter et stocker vos précieuses bouteilles plutôt que de garer votre argent dans des ETFs d'alcool.

Partager cet article