Wine ETFs (What They Are and How to Invest in Them)

14 min read

Head of Content

What are ETFs

Exchange-Traded Funds (ETFs) are a type of investment fund and exchange-traded product, representing an ensemble of securities such as stocks that regularly track an underlying index, although they can invest in any number of industry sectors or use various strategies. Essentially, ETFs are akin to mutual funds, yet they are openly traded like an individual stock on a stock exchange.

Unlike mutual funds which are priced at the end of each trading day, ETFs are priced continuously throughout the trading day. This perennial pricing aligns with the fluctuating quality of the market, and thus, gives investors the freedom to buy and sell ETF shares at any moment during regular trading hours as they would ordinary stocks.

While ETFs, essentially, aim to emulate the performance of their benchmarks, it is of paramount importance to remind oneself that emulation doesn't necessarily equate to replication. Hence, while an ETF may strive to mirror the return of its benchmark index, a perfect match is never a guarantee. Investors are often pleasantly surprised to find ETFs occasionally outperforming through what is referred to as overperformance their benchmark indexes; on the other side of the spectrum, it isn't uncommon to find ETFs trailing their benchmark indexes a phenomenon known as underperformance.

Another vital aspect of understanding ETFs pertains to their creation and redemption process. When an ETF provider wishes to create a new tranche of an ETF, they elect an authorized participant usually a large institutional investor to acquire the set of assets the ETF aims to track. These assets, often referred to collectively as a 'Creation Basket', are then exchanged for new ETF shares of equal value. The inverse process is executed when shares need to be "redeemed" or taken out of circulation.

ETFs are hailed for their characteristic versatility, attributable, no doubt, to the expansive list of assets into which they allow investment. Investors can choose ETFs that focus on everything from traditional equity and bond offerings to those targeting more exotic commodities such as gold, oil, or, in this context, wine and alcohol—the focal point of this discourse

How to Buy Wine ETFs?

One often encounters the unquestionable reality: there exist zero ETFs solely dedicated to wine investment.

However, it is not a dead-end for wine enthusiasts. A possible pathway for investment exists in broad-based ETFs, ones that incorporate wine in their portfolio, typically classified as alcohol ETFs.

What are Alcohol ETFs?

Exchange-Traded Funds (ETFs) focusing on the alcohol industry, particularly referred to as Alcohol ETFs, denote assets that offer investors the possibility to generate profit through exposures in the beverage sector, more specifically, alcoholic beverages. These investment vehicles assemble a pool of different financial instruments such as currencies, bonds, commodities, and equities like stocks of companies engaged in the production, distribution, and sale of alcoholic beverages - beer, wine, and spirits to be precise.

These ETFs lean heavily on the consumer staples sector, contingent on the discretionary income levels and economic health of consumers. This fundamentally renders the performance of Alcohol ETFs largely resilient to economic downturns, a unique advantage that classifies them as defensive or non-cyclical investments. Furthermore, they benefit from the global popularity and ubiquity of alcoholic beverages, making them attractive long-term investment opportunities.

The Alcohol ETFs generally track the performance of indexes associated with the alcohol industry. The composition of ETFs hinges on the respective index, tracking companies of various sizes and geographic locations. These ETFs may hold stocks of companies ranging from multinational conglomerates dominating the international alcohol market, such as Anheuser-Busch InBev, Diageo, and Pernod Ricard, to smaller companies with a regional presence.

Strict legal regulations surrounding the alcohol industry, competitive market dynamics, and social factors influencing drinking norms are some of the unique risks associated with these ETFs. Thus, investors need to consider these factors while evaluating the risk-reward profile of alcohol ETFs.

Top Alcohol ETFs to Invest In

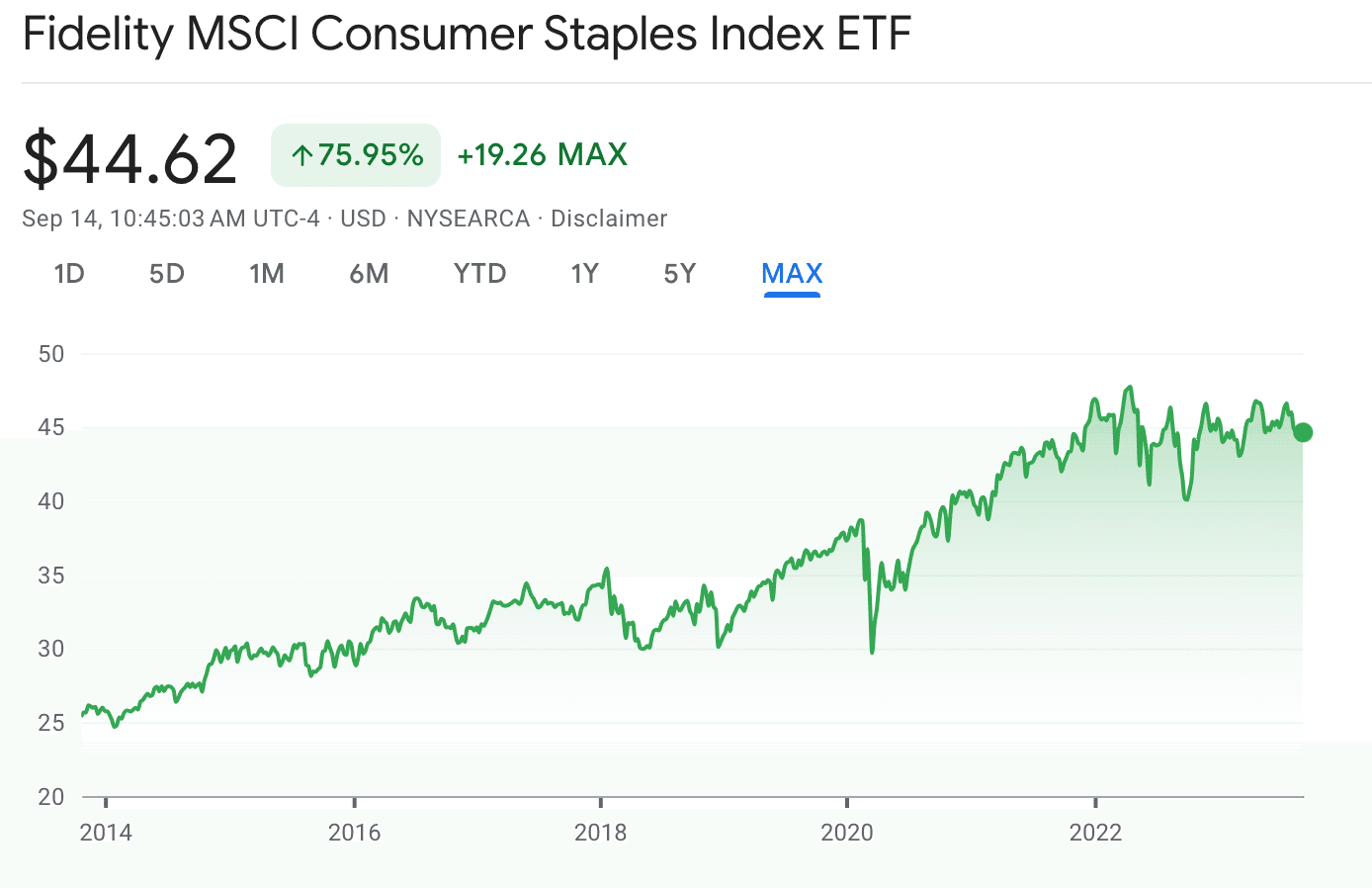

Fidelity MSCI Consumer Staples Index ETF

The Fidelity MSCI Consumer Staples Index ETF (FSTA) is an investment opportunity tied to the wine and alcohol industry. It tracks the MSCI USA IMI Consumer Staples Index, with a focus on sectors like food, staples retailing, beverages, and more. Notably, beverages, including alcohol, account for about 22% of the index.

FSTA follows a passive investment strategy, aiming to echo the performance of the index rather than

Source: Google Finance

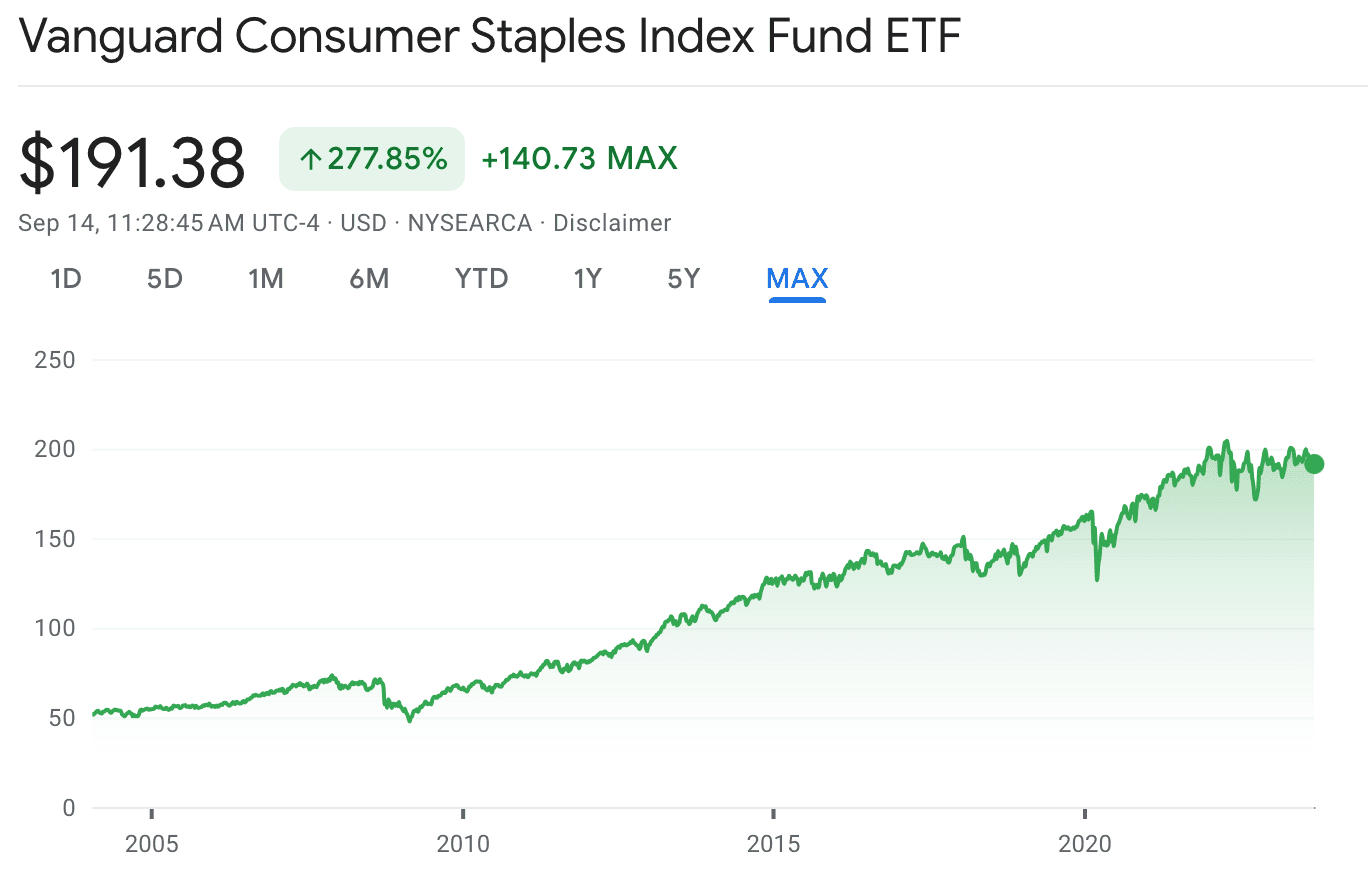

Vanguard Consumer Staples Index Fund ETF (NYSEARCA: VDC)

The Vanguard Consumer Staples Index Fund ETF (VCSAX) is a popular finance market choice, of US firms in the consumer staples sector. It has a passive management style with a low 0.10% expense ratio.

Investors can get extensive exposure to alcohol companies like Anheuser-Busch InBev and Diageo through this fund. As these products often see increased consumption in economic downturns, investing in this fund is considered relatively safe.

AdvisorShares Vice ETF (NYSEARCA: VICE)

The AdvisorShares Vice ETF is a thematic ETF that invests in 'sin' industries like alcohol production. It participates in wine, spirits, beer, and other alcoholic beverage companies, benefiting from consistent consumption effectively amid economic changes.

Launched in 2017, this ETF (ticker: ACT) stands out from standard alcohol ETFs because it incorporates tobacco and cannabis sectors. Its distinct portfolio offers diversified exposure to 'sin' industries, particularly alcohol.

The AdvisorShares Vice ETF has shown its resilience in market fluctuations, underlining the robustness of its target sectors. This ETF boasts a variety of 40+ stocks of variable market capitalizations, ranging from large brewing companies to smaller wine producers.

Source: Google Finance

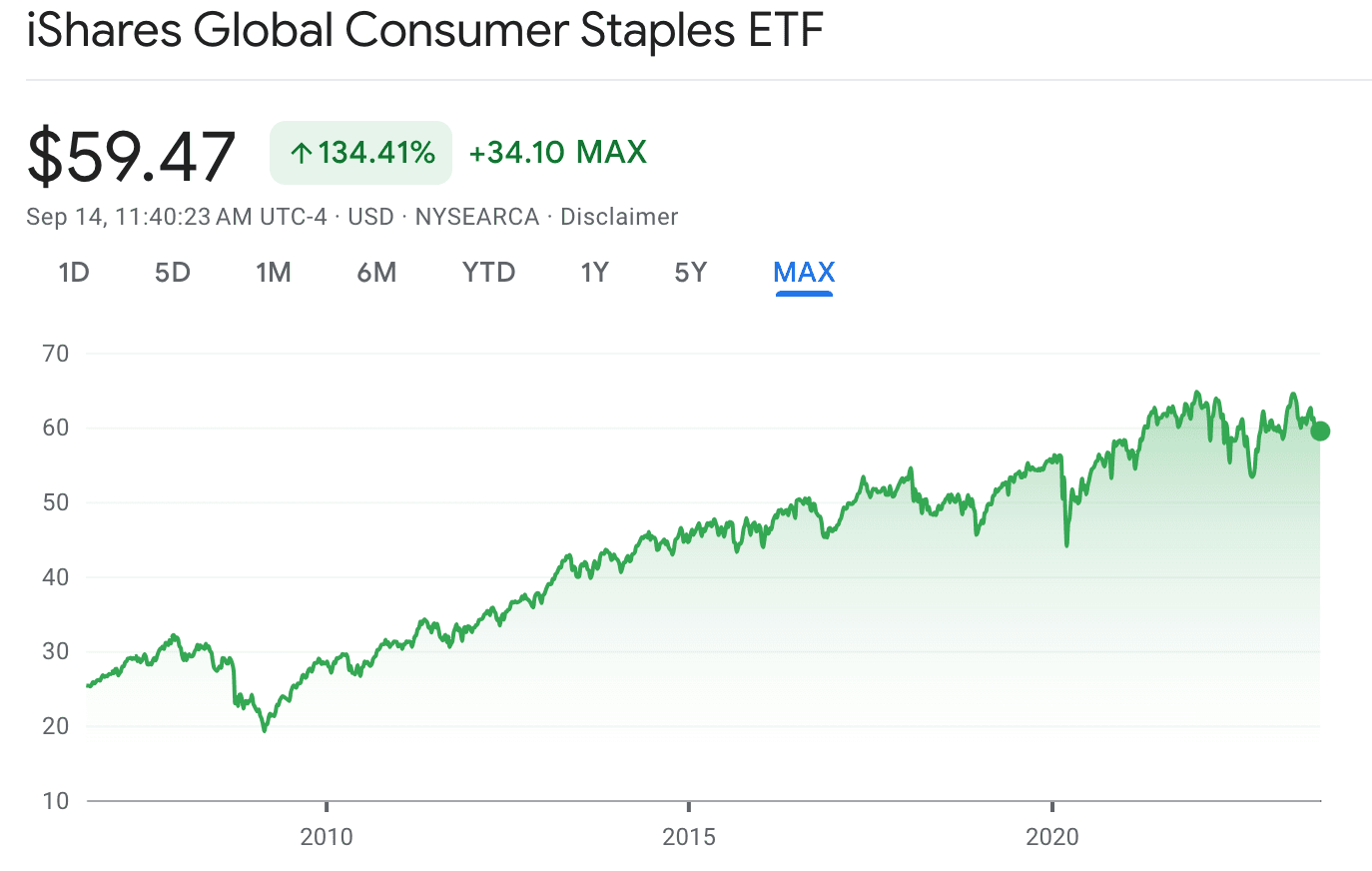

iShares Global Consumer Staples ETF (NYSEARCA: KXI)

The iShares Global Consumer Staples ETF (KXI) is a fund covering the global and Coca-Cola. These companies make up a large portion of the ETF.

The ETF aims to mirror the performance of the S&P Global 1200 Consumer Staples Sector Index, using a passive management strategy. It allows investors to gain from capital appreciation and dividend payments of its holdings.

Investors interested in the wine industry may consider this ETF. Although not solely focused on wine or alcoholic beverages, many of the food and beverage companies in the portfolio are also involved in wine and alcohol production and distribution.

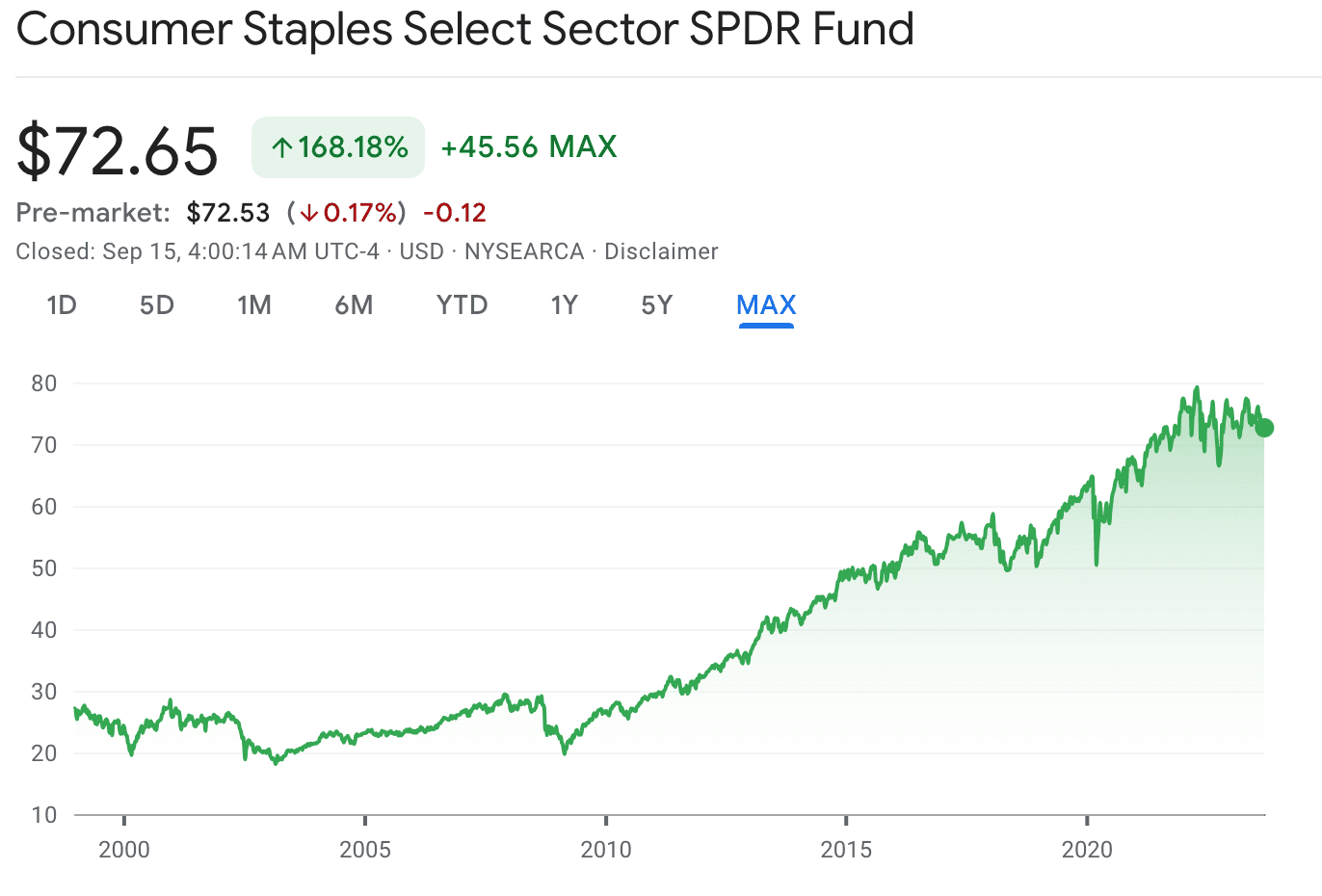

Consumer Staples Select Sector SPDR Fund (NYSEARCA: XLP)

The Consumer Staples Select Sector SPDR Fund (XLP) is a reliable choice within the alcohol ETF market. Initiated in 1998, it tracks the Consumer Staples Select Sector Index. The Index includes a diverse array of companies like those in food, drug retail, beverages, tobacco, and household products.

As per the end of 2021, has a low expense ratio of 0.12%, making it cost-effective for investors planning on a long-term investment.

Therefore, the XLP ETF is a favorite among investors, both new and experienced, for its stability, diversified exposure to staple sectors like alcohol and beverages, and its potential for steady returns.

Investing in the wine industry via alcohol-based Exchange-Traded Funds (ETFs) certainly presents an intriguing opportunity. However, it is crucial to understand that these ETFs merely permit investment into wine as one part of a larger asset class, rather than enabling one to exclusively invest in wine.

Fortunately, there are other ways to make the most of the high-return secondary wine market.

Invest in Wine Stocks

Constellation Brands, Inc. (NYSE: STZ)

Constellation Brands, Inc. is a well-known name in the alcohol sector, making it a solid investment opportunity. Established in 1945, it has an impressive collection of alcohol brands, showcasing its remarkable growth.

From a fiscal perspective, the company has demonstrated an ongoing track record of robust returns and growth of revenue. In the fiscal year 2020, the company posted net sales growth of 3% compared to the prior fiscal year and achieved an operating cash flow of approximately $2.1 billion. Its beer business segment delivered net sales growth of 8% in the same year.

On the New York Stock Exchange, Constellation Brands, Inc. trades under the ticker symbol 'STZ'. The fiscal data of Constellation Brands unveils an ongoing track record of strong returns and revenue growth. Some iconic brands under its umbrella include Corona Extra, Modelo Especial, Robert Mondavi, Kim Crawford, Ruffino, and SVEDKA Vodka.

Diageo plc (NYSE: DEO)

Diageo plc is a British multinational beverage company renowned for its wide array of world-class spirits, wines, and beers. With headquarters in London, the company maintains a significant presence in the global wine industry, thus making it an investment consideration for those interested in wine-focused financial instruments.

Notably, Diageo holds the distinction of being the world's largest producer of spirits, boasting an incredible portfolio that includes renowned brands such as Don Julio, Tanqueray, Baileys, and Guiness. However, their investment value does not solely stem from their spirit offerings. In the wine landscape, Diageo owns a substantial number of prestigious wine estates and labels, thus positioning the company favorably in the equity market from a wine-centric perspective.

As it stands, Diageo stock (DEO) is listed on both the London and New York Stock Exchanges. From an investment viewpoint, there are several compelling factors drawing attention to this stock. Firstly, Diageo has consistently showcased strong performance in terms of revenue and dividend payments, portraying an image of a reliable and stable investment. Further, the company's robust business model, underpinned by diversified alcohol offerings and a wide geographic footprint, reduces its susceptibility to market fluctuations and enhances its resilience in the face of economic downturns.

Brown-Forman Corporation (NYSE: BF.B)

The Brown-Forman Corporation, listed on the New York Stock Exchange under the ticker symbol BF.B, is a notable player within the global alcoholic beverage industry. This multifaceted corporation, established in 1870, operates in more than 170 countries and boasts an impressive portfolio of over 25 brands.

Financially, Brown-Forman Corporation exhibits robust health, nonetheless, investing in its stocks necessitates analysis of different elements. The corporation's consistent dividend payments and a progressive share repurchase program are factors to be contemplated by potential investors.

The company's commitment to increasing its dividend payments to shareholders is a strong fiscal marker. The Brown-Forman Corporation has been successful in enhancing its dividends annually for the past 37 years, manifesting financial stability. Recently, the corporation hiked its dividends by 5%, a progressive trend that suggests promising well-being.

Another factor that embodies the financial health of this corporation is its share repurchase program. Over the past ten years, Brown-Forman Corporation has repurchased approximately $2.5 billion of its own stock, leading to a reduction in outstanding shares. This activity generates shareholder value, as it increases earnings per share and often leads to a rise in stock prices.

Willamette Valley Vineyards, Inc. (NASDAQ: WVVI)

Willamette Valley Vineyards, Inc. is a leading grower and producer of fine wines made from the Pinot Noir grape, recognized as one of America's premier appellations for this variety. Its vineyards are situated in Oregon's Willamette Valley, a region acclaimed for producing some of the highest quality Pinot Noir in the world due to its unique climate and soil conditions. The company's shares are traded on the NASDAQ under the ticker symbol WVVI.

Willamette Valley Vineyards has demonstrated a strong and consistent performance in a highly competitive market, outpacing many of its industry counterparts. This observation is underscored by its historical financial data. However, like any other investment, this one also necessitates a thorough analysis of its underlying performance metrics.

The company frequently reports robust operational figures, with numerous growth indicators. For instance, the company's consistent revenue growth over several fiscal years reflects its strong market presence and consumer demand for its products. This is partly due to their strategic efforts towards branding and product diversification, allowing them to tackle a broad consumer base while maintaining quality.

The company's earnings per share (EPS) also show a noticeable upward trend, a promising signal for future growth. This paints a picture of the company’s profitability on a per-share basis and provides insights into the firm’s financial health. A growing EPS frequently indicates a company’s ability to generate profits and return them to shareholders.

LVMH Moet Hennessy Louis Vuitton SE (EPA: MC)

LVMH Moet Hennessy Louis Vuitton SE, colloquially known as LVMH, represents an intriguing opportunity for investors looking to diversify their portfolio through holdings in the alcohol and luxury goods sector. The conglomerate, headquartered in France, has a vast array of prestigious brands under its registry, including notable wine and spirits brands such as Moet & Chandon, Hennessy, Dom Perignon, and Veuve Clicquot.

LVMH has demonstrated a consistent pattern of revenue growth and profitability, attributable to the enduring power and appeal of its brands. Thus, investing in LVMH stock might effectively serve as a proxy for a diversified investment in the global high-end wine and spirits market. However, investors must comprehend the inherent risks associated with any type of equity investment.

From a financial perspective, LVMH reported a revenue of €44.65 billion for the first half of 2021, marking a notable recovery from the dip experienced in 2020 due to the Covid-19 pandemic. Their wines and spirits sector alone contributed to 10% of this overall revenue, reflecting the sustained demand for high-end wines and spirits even in the wake of economic disruptions.

Their strategic business model which encompasses not only wines and spirits but also fashion, perfume and cosmetics, and jewelry among others, offers a degree of insulation against sector-specific downturns or disruptions. The diversified revenue streams potentially reduce the risk associated with pure-play wine investments.

Wine Funds

Wine funds, in their essential nature, bear a close resemblance to private equity funds. This remarkable similarity is the reason why financial advisors often presume these funds as brokers of potential benefits to the investors.

Managed diligently by fund managers possessing profound knowledge of the field, these wine funds elevate the investment scenario.

Wine Source Fund

This fund lets you invest in a diversified portfolio of international fine wines and vineyards.

Managed by - WSF SICAV.

Annual Returns - 7%.

The Wine Investment Fund

This fund lets you invest specifically in Bordeaux wines that are stored in bonded warehouses, and sold at the right time.

Managed by - Anpero Capital.

Anual Returns - 7.1%.

Vini Sileo Vineyard Fund

This fund lets you own vineyards in France, Portugal, and Italy through fractional ownerships (several parties share and mitigate the risk of ownership).

Managed by - Vinito Capital Management.

Annual returns - 10%.

Sommelier Capital Advisors Hedge Fund

This is an actively managed global wine investment fund.

Managed by - Sommelier Capital Advisors.

Annual returns - Not available.

Watermark Fine Wine

This fund actively trades a portfolio of recent vintages of first-growth Bordeaux wines.

Managed by - Watermark Fine Wine.

Annual returns - Not available.

It is crucial to understand that engaging in wine fund investments presupposes the likelihood of your funds being entwined within the web of investment for a duration spanning up to five years. The procedure to elicit the redemption of your request could encompass a timespan of weeks.

An alternative strategy that holds allure is the acquisition of investment-grade wine bottles, securing them in storage, and subsequently offering them for sale at prestigious wine auctions or on exclusive wine stock exchanges, such as the renowned London International Vintners Exchange (Liv-Ex).

You could buy premier crus and first-growth wines from Bordeaux, Burgundy, or any other reputed wine region.

The best part is: you don’t have to do all this yourself - just use a collectible wine marketplace like Rekolt.

Let’s see how you can do this.

Directly Investing In Wine Bottles with Rekolt

Rekolt is a platform that lets you collect sought-after wines that historically outperform the market.

How to Invest with Rekolt

You need to follow a simple three-step process:

Purchase a wine on the marketplace

Track your portfolio real-time.

Why Should You Use Rekolt?

Rekolt makes it easy to buy and manage wines. We research, authenticate, buy, store, and insure the wine for you.

Authenticity

Rekolt traces the provenance and checks the authenticity of each wine bottle.

Best Prices

We source wines directly from wineries, global wine exchanges, and merchants at the best possible wholesale prices.

Optimal Storage

The wine cases are stored in optimal conditions of humidity, temperature, air quality, light, and vibration with experienced storage providers.

Full Insurance

Our policy covers any breakage or accidental leakage that may occur, ensuring that our customers' investments remain safe and secure. In the event of any damage or loss, you’ll be immediately notified and refunded to your account.

What are the Benefits of Investing Through Rekolt Over ETFs?

There are three key benefits of investing in wine through Rekolt vs. through ETFs:

It provides a solid hedge against market volatility (unlike real estate or stock markets). Consider this: wine has outperformed the S&P 500 index over the last 20 years, including during downturns.

You can invest solely in wine, rather than a mix of commodities which may or may not guarantee stable returns.

You get full ownership over the wines you invest in.

While investing in alcohol ETFs can help you invest in wines, they’re not an ideal option.

You’ll be better off using a trusted, online platform like Rekolt to select, buy, and store your precious bottles instead of parking your money in alcohol ETFs.

Share this article