#

Product

Price

Return

#

Product

Price

Return

6

Domaine de la Romanee-Conti, Grands Echezeaux Grand Cru2020

Price: $2,982.93

$2,982.93

-$752.89

▼-25.24%

9

Domaine de la Romanee-Conti, Romanee-Conti Grand Cru2020

Price: $19,524.60

$19,524.60

-$3,209.84

▼-16.44%

#

Product

Price

Return

#

Product

Price

Return

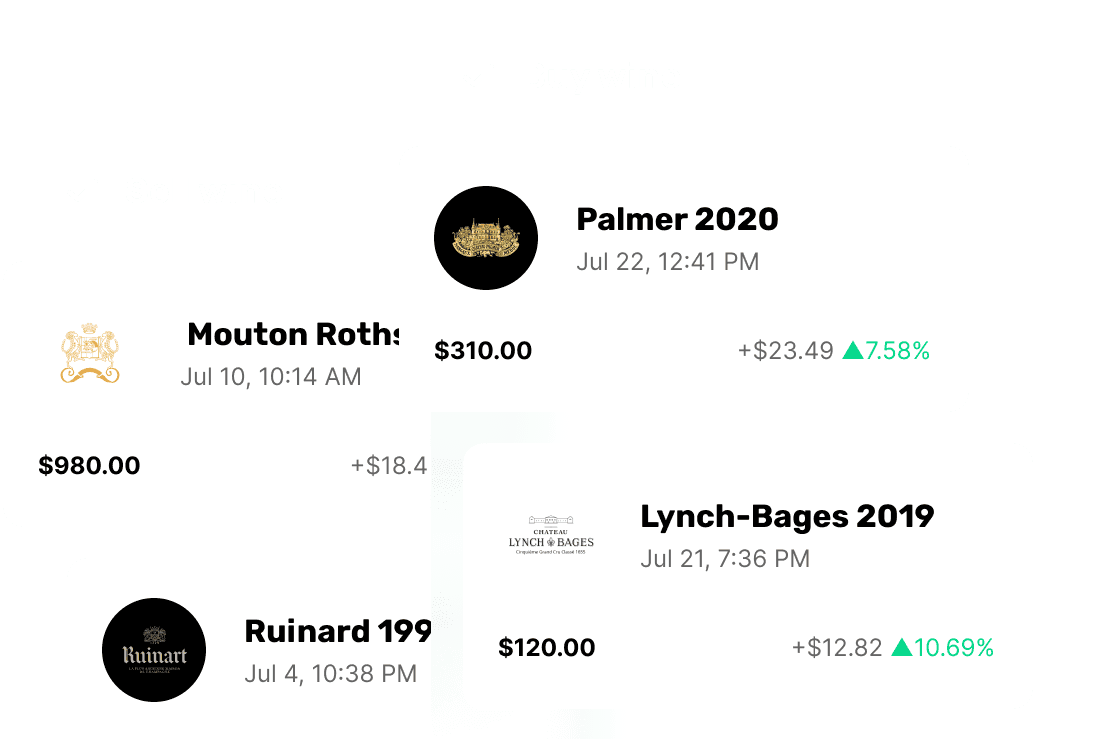

New in

Big Guns of Bordeaux

Top producers

Blue Chips of Bordeaux

How it works?

Your guide to creating your cellar

Help

Your questions answered

Chat with us

Contact our Support team

Need help getting started with your cellar?

Inspiration for future tastings

- Red wines Bordeaux

- Rosé wines Bordeaux

- White wines Burgundy

- White wines Bordeaux

- Rosé wines France

- White wines France

- Red wines France

- Red wines Burgundy

- Rosé wines All regions

- Red wines All regions

- Merlot All regions

- Chardonnay All regions

- Cabernet Sauvignon All regions

- Malbec All regions

- Sweet wines All regions

- Dry wines All regions

- Dry white wines All regions

- White wines All regions

- Sweet white wines All regions

- Sweet red wines All regions

- Dry red wines All regions

- Wines to drink now All regions

- Wines for collecting All regions

- Wines for investing All regions